Buying a house can be a complicated process, and one aspect of it that many people don’t fully understand is stamp duty. So, to help clear up any confusion and answer your burning questions, we’ve created this simple guide to stamp duty in 2024.

What is stamp duty?

Stamp duty land tax (SDLT) is a tax that’s payable when buying property or land in England and Northern Ireland. It’s paid by the buyer on completion of the purchase, and the amount you pay depends on the cost of the property.

Not everyone has to pay stamp duty – some first-time buyers are exempt, for example – but some people will have to pay a higher rate, such as most buy-to-let landlords.

What are the 2024 stamp duty rates and how much will I pay?

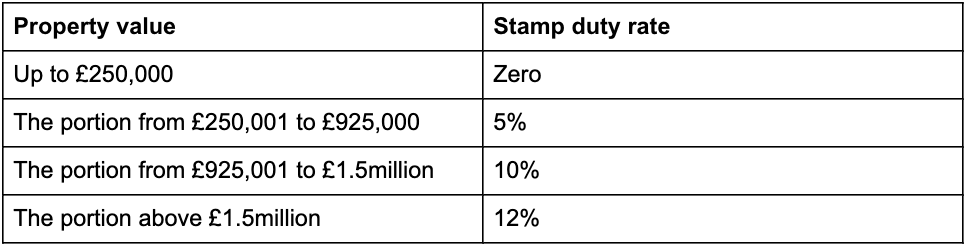

The amount of stamp duty you’ll pay depends on which price threshold the property you’re buying sits within, as well as what sort of buyer you are. Stamp duty rates are set to remain as they are until 31 March 2025. This means that 2024 stamp duty rates for home movers – whose purchase is not their first home, but will be the only home they own – are as follows:

The rate of stamp duty is only payable on the portion of the property price above a certain threshold, not on the entire cost.

So, if you were to buy a home for the UK average house price of £291,000, you’d pay stamp duty on the £41,000 that sits above the £250,000 threshold. This means you’d pay £2,050.

If you’re buying a home for £500,000, you’ll pay £12,500, while for a property costing £750,000, you’ll pay £25,000 in stamp duty.

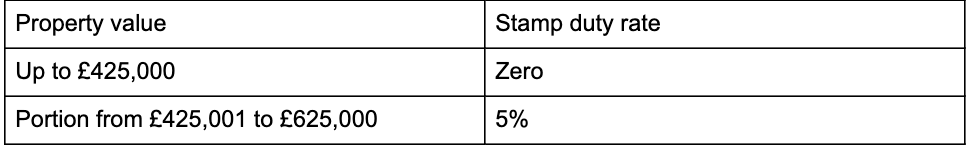

First-time buyers, however, often qualify for a stamp duty discount, meaning that many people joining the property ladder don’t have to pay stamp duty at all. The stamp duty relief rates for first time buyers are:

This means that, as a first-time buyer, you won’t pay any stamp duty if the purchase price of the home you’re buying is £425,000 or less. If it is between £425,001 and £625,000 you will pay 5% on the portion of the price that is above £425,000.

But if the home costs more than £625,000, you will have to pay the full rate of stamp duty.

There is often extra stamp duty on buy-to-let properties. If you already own another property in addition to the buy-to-let, you’ll have to pay the stamp duty surcharge of 3% on top of the regular rate.

You can use a stamp duty calculator to work out exactly what you’ll need to pay.

How do I pay stamp duty?

Stamp duty is always paid by the person who is buying the property, and it must be paid within 14 days of the property transaction completing. Usually, stamp duty will be included in the final costs your solicitor or conveyancer will ask you to pay on completion, and then they will file the stamp duty tax return to HMRC on your behalf.

For more help and advice on buying or selling property in 2024, contact Carter & May.