If you’re buying a property to let out, you need to be clued up on all the expenses involved. The most significant of these is likely to be stamp duty land tax (SDLT). This is a tax applied to property purchases in the UK, paid by the buyer on completion.

Most buy-to-lets are not exempt from stamp duty, and buyers are usually required to pay a 3% surcharge on a buy-to-let property. But the rules around stamp duty on buy-to-let properties are complicated, and it can be tricky to figure out what you should be paying.

We’ve set out some key considerations to help you work out how much stamp duty you’ll owe on your buy-to-let.

1. Where is the property?

Rates vary for properties being bought in different parts of the UK. England and Northern Ireland use the same rates, which we will focus on here, but it differs in Scotland and Wales, so make sure you understand which rates apply to you.

2, Do you own another property?

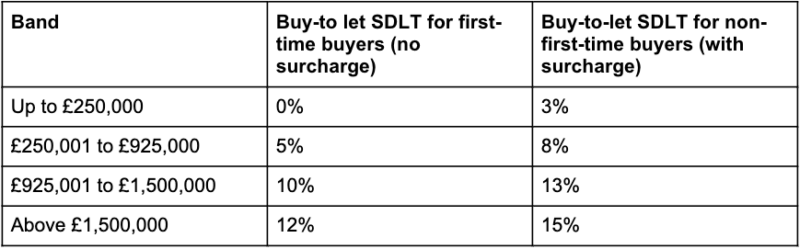

If you already own another property in addition to the buy-to-let, you’ll have to pay the stamp duty surcharge of 3% on top of the regular rate. But if you’re a first-time buyer, or if the buy-to-let will be the only property you own, you won’t have to pay the surcharge.

However, if you are a first-time buyer with your eye on a buy-to-let, be aware that you won’t qualify for the first-time buyer stamp duty relief – which waives stamp duty on properties up to £425,000 for first-time buyers. This is because the first-time buyer relief is dependent on the property being your primary residence.

3, What is the property price?

Stamp duty rates are banded according to property price, as follows:

4, Are you a UK resident?

Non-UK residents are subject to an extra 2% on the stamp duty rate when purchasing a buy-to-let property in England or Northern Ireland. The definition of residence when it comes to stamp duty can differ from nationality or residency for other tax purposes, so make sure you double check whether it applies to your circumstances.

For stamp duty, you are considered a UK resident as long as you have been present in the UK for at least 183 days in the 12-month period before the purchase.

5, What sort of property is it?

You won’t have to pay any additional stamp duty on caravans, mobile homes and houseboats.

If you are buying more than one ‘dwelling’ as part of the same transaction, for example, several flats from a developer, you may be able to claim a discount on the stamp duty owed.

This is known as Multiple Dwellings Relief (MDR). With MDR, stamp duty is applied to the average value of the properties, then multiplied by the number of them, rather than applied to the price of individual properties or the total purchase price.