If you’re a first-time buyer, you probably have a lot of questions. Buying your first home is incredibly exciting, but it can be overwhelming, with plenty to wrap your head around.

There are also many costs to consider, and one of the biggest expenses involved in buying a property is often stamp duty land tax (SDLT). But not everyone has to pay stamp duty, or at the same rate, so you’re probably wondering, ‘Is there stamp duty for first-time buyers?’

The answer: sometimes – but if you do, you’ll probably pay much less.

Let’s look into it further.

What is stamp duty?

Stamp duty land tax (SDLT) is a tax payable when buying property or land in England and Northern Ireland. It’s paid by the buyer on completion and the amount you pay will depend on the cost of the property you’re buying, and which threshold it sits above.

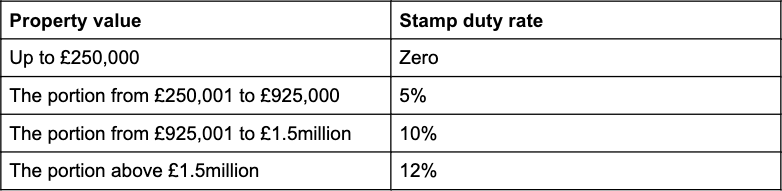

The current stamp duty rates, as of 23 September 2022, and until 31 March 2025, are as follows:

It’s important to remember that the rate of stamp duty is only payable on the portion of the property price above a certain threshold, not on the entire cost.

Does stamp duty apply to first-time buyers?

There is a stamp duty discount available for people who are buying their first home, and it means that many first-time buyers don’t have to pay any stamp duty at all. But some do.

The stamp duty relief rates for first time buyers are:

This means that, as a first-time buyer, you won’t pay any stamp duty at all if the purchase price of the home you’re buying is £425,000 or less. If it is between £425,001 and £625,000 you will pay 5% on the portion of the price that is above £425,000.

But if the home you are buying costs more than £625,000, you will have to pay the full, standard rate of stamp duty, and cannot claim any first-time buyer relief.

For example, if you’re buying your first home and it costs £350,000, you will not have any stamp duty to pay. If it costs £600,000, you will pay 5% on the portion of the price that is over the £425,000 threshold, so you would pay £8,750 in stamp duty.

But if you are buying a home for £650,000, you will have to pay £20,000 in stamp duty – whether you are a first-time buyer or not.

There are some exceptions. For example, if you are a first-time buyer looking to purchase a buy-to-let property, you won’t qualify for the first-time buyer stamp duty relief. This is because the relief is dependent on the property being your primary residence.

If you’re a first-time buyer, check how much stamp duty you will need to pay on your new home using a stamp-duty calculator.